Maxi-Cash powers neobanking service with fintech company MatchMove

Maxi-Cash powers neobanking service with

fintech company MatchMove

SGX-listed pawnbroker Maxi-Cash has announced that it will be powering its neobanking service, MaxiPay, with fintech company MatchMove. MaxiPay is a personal mobile e-wallet that comes with a virtual account. The account also comes with a prepaid MatchMove-enabled Mastercard-branded virtual and physical card.

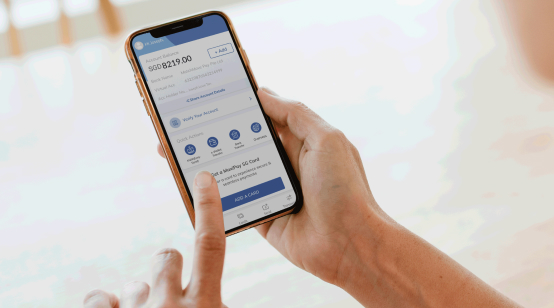

The service is said to improve the end-to-end engagement for consumers to remit their money. With MaxiPay, Maxi-Cash users will now be able to top-up and transfer out money in real time. They will also be able to spend via their prepaid virtual cards and perform domestic FAST transfer. International remittances will also be cheaper with the service.

“As an innovative leader in the pawnbroking industry, Maxi-Cash aspires to provide access to greater demographics by leveraging fintech providers like MatchMove, which enable us to offer neobanking. Providing convenience and meeting short-term financial needs of our customers have been core to the growth of Maxi-Cash,” says Ng Kean Seen, CEO of Maxi-Cash.

“MatchMove is deeply committed to advancing financial inclusion across the region, for individuals and businesses, and we are excited to partner with Maxi-Cash in taking this vision forward,” says MatchMove’s chief commercial officer, Amar Abrol.

“With our Lightspeed technology solution, Maxi-Cash has launched MaxiPay, its own branded app to provide best-in-class digital financial services to the underserved segments of society, like migrant workers.

We are confident that this solution will solve the challenges faced by these consumers with cheap and convenient money transfers as well as accessing other digital payment services,” he adds.

916 Gold:

916 Gold: